The trucking world isn’t exactly famous for overnight revolutions. Change comes slowly, measured in miles, margins, and manpower. Yet over the past few years, Uber Freight has quietly turned one of the most analog industries into a digital ecosystem where routes, rates, and relationships live inside a single app. Backed by Uber’s broader technology DNA, the freight division now bridges carriers and shippers through automation, AI-driven forecasting, and real-time visibility. The result isn’t just faster loads, it’s a redefinition of who controls logistics efficiency.

Backed by Uber’s broader technology DNA, the freight division now bridges carriers and shippers through automation, AI-driven forecasting, and real-time visibility. The result isn’t just faster loads, it’s a redefinition of who controls logistics efficiency.

The story of Uber Freight isn’t about trucks and loads. It’s about how data itself became the driver.

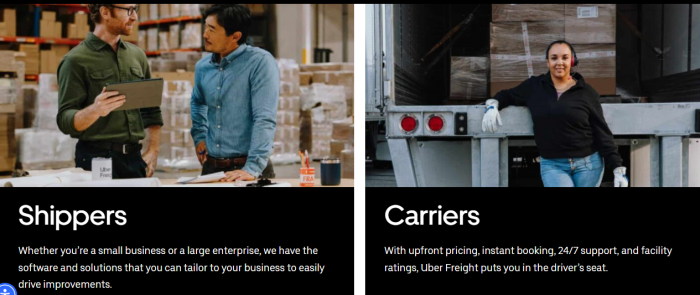

The Platform That Connects the Dots Between Shippers and Carriers

For drivers and fleet owners, the Uber Freight carrier platform feels like a blend between a load board and a navigation tool that knows your business. You can book shipments instantly, track pay, and receive performance-based recommendations, all from the mobile app available on Android and iOS.

For shippers, the interface provides full shipment transparency, tracking, invoicing, proof-of-delivery, and dynamic pricing. Uber’s AI infrastructure helps balance capacity across the network, predicting supply-demand shifts and even rerouting loads in response to weather or fuel costs.

The mission here is simple: replace back-and-forth calls with predictive logistics.

Why AI Has Become the Co-Driver of Modern Freight

The recent Uber Freight AI report lays out a vision for a self-optimizing logistics network. Machine learning models anticipate available capacity, optimize route efficiency, and even pre-price shipments before customers request them. For drivers, this means fewer empty miles and better-paying loads. For shippers, it means consistent pricing and shorter turnaround times. A feature in Business Insider notes how Uber Freight’s AI now integrates with external APIs for weather, traffic, and maintenance data to make real-time route recommendations.

For drivers, this means fewer empty miles and better-paying loads. For shippers, it means consistent pricing and shorter turnaround times. A feature in Business Insider notes how Uber Freight’s AI now integrates with external APIs for weather, traffic, and maintenance data to make real-time route recommendations.

AI isn’t replacing dispatchers, it’s making dispatch smarter.

Life on the Carrier Side

Independent truckers on Reddit’s r/FreightBrokers describe Uber Freight as “one of the cleaner apps in the market” and appreciate transparent pay, although many say competition can be tough for high-paying lanes. Reviews on Capterra echo similar themes:

“Quick booking, easy to navigate, but rates can fluctuate fast.”

“Reliable payment system, app could improve map accuracy.”

Truckers who prefer autonomy see it as a fair trade: less negotiation, more control. The support guide also provides a step-by-step walkthrough for new carriers, covering registration, document upload, and the in-app bidding process.

The learning curve exists, but it’s short. The payoff is efficiency.

Inside the Numbers: Growth and Ground Reality

According to FreightWaves’ Q3 analysis, Uber Freight revenue remained flat last quarter despite overall volume growth, a sign of macro headwinds in freight rates rather than platform performance. While revenue steadied, cost efficiency improved thanks to automation and digital brokerage.

Internally, Uber Freight continues to emphasize contract logistics and enterprise shippers, which now form the majority of its load mix. The Gartner Peer Insights listing notes strong satisfaction among 3PL clients for integration, visibility, and customer support.

The company isn’t chasing hypergrowth; it’s building endurance in a volatile market.

The Human Factor Behind the Tech

At the core of Uber Freight’s logistics engine is its people: planners, developers, and support staff who merge AI predictions with real-world intuition. On Glassdoor and Indeed, employees highlight culture and mission alignment:

“Feels like a startup with global infrastructure.”

“AI is only as good as the teams maintaining it.”

That human layer, drivers, analysts, dispatchers, anchors the technology. Automation may guide the workflow, but empathy still drives the business relationships behind it.

Freight remains personal, even when powered by algorithms.

A Future Driven by Predictive Networks

The next evolution of Uber Freight appears focused on network intelligence, connecting fragmented carriers into predictive clusters that move cargo like a living system.

In this model, trucks don’t just drive, they communicate: sharing route data, predicting delays, and rerouting themselves automatically.

It’s a shift from logistics as scheduling to logistics as synchronization.

When roads become data streams, efficiency stops being a choice, it becomes the default.

A Balanced View from the Field

Despite the progress, challenges remain. Smaller carriers worry about pricing transparency. Some truckers prefer the human negotiation of traditional brokers. And on the enterprise side, a few TruckingOffice contributors say “automation doesn’t always capture on-the-ground complexity.”

Yet even critics acknowledge Uber Freight’s responsiveness, whether through in-app support or LinkedIn updates detailing continuous feature rollouts.

The road isn’t frictionless, but it’s undeniably digital.

A Broader Look: Uber Freight’s Role in the AI Supply Chain Revolution

What began as an Uber spinoff has become a quiet backbone of AI logistics. As more freight networks digitize, data transparency may matter as much as delivery time. Uber Freight’s value isn’t just in miles driven, it’s in predictive understanding: who needs capacity, when, and at what cost.

If Uber Eats digitized restaurants, Uber Freight is digitizing roads.

It’s not a platform, it’s a pattern forming in plain sight.

Final Reflection

The freight industry has always measured success by speed and reliability. Uber Freight adds a third dimension: clarity. In a sector often defined by uncertainty, rates, and loads, brokers, it offers visibility in real time.

For carriers, that visibility means control. For shippers, it means trust. And for logistics as a discipline, it marks the moment AI stopped being a buzzword and became part of the supply chain bloodstream.

The open road might still belong to drivers, but the dashboard now belongs to data.

Comments