Boundless Learning was positioned as a modern EdTech engine — a company claiming 30 years of instructional experience, 450+ online programs, and a global reach serving 17,000+ learners annually. But behind that polished corporate language, something entirely different was unfolding internally. Over the past two years, Boundless Learning has become one of the most talked-about layoff cases in global EdTech, not because of its scale alone, but because of how those layoffs were executed and what they reveal about the structural instability of the sector.

This investigation takes a ground-up look at the firm’s layoffs using publicly available data, employee testimonies, internal timelines, and contextual indicators from analyst reports. The goal is to understand not only what happened, but why a company marketed as a “learning transformation partner” suddenly became a case study in organizational mismanagement.

1. The Company Behind the Turbulence

Boundless Learning emerged after the 2023 sale of Pearson Online Learning Services (POLS) to Regent LP, a private equity firm with no prior educational portfolio. The rebrand promised modernization, agility, and “future-ready learning services.” But from day one, the firm carried a burden:

POLS had already lost major contracts, including heavy-hitting partnerships like ASU and Ohio University, shrinking its revenue base dramatically.

When Regent acquired the unit, the purchase agreement structured Pearson’s ongoing earnings as 27.5% of Boundless Learning’s adjusted EBITDA, creating a financial model where aggressive cost-cutting was not just predicted — it was built into the deal structure itself.

This becomes crucial in understanding the layoffs that followed.

2. What Employees Reported Before the Layoffs Even Began

Long before Boundless Learning became a headline, employees internally were already reporting warning signs:

● Hiring freezes months before the rebrand

● Non-functional backfills

● Contract modifications removing severance protections

● Increasing micromanagement

● The introduction of performance frameworks described as “call center metrics disguised as education work”

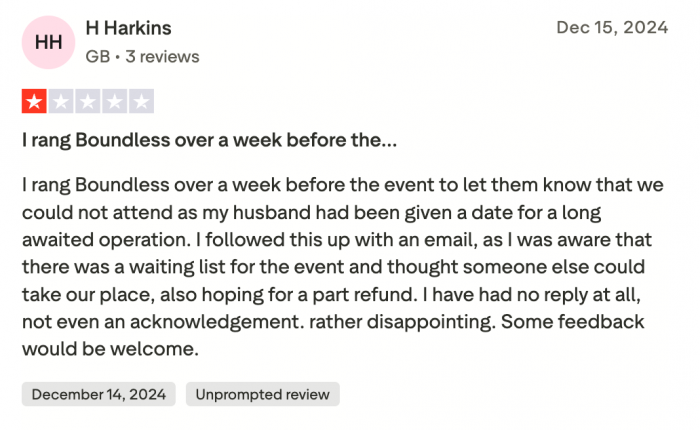

Glassdoor reviews paint a bleak picture. Across 79 reviews, the company averages 2.8 stars, well below the education industry’s 3.7-star average. A recurring theme emerges:

Regent LP’s influence overshadowed any educational mission, shifting Boundless Learning into a profit-first model that many employees say clashed with the nature of academic work.

3. The Layoff Timeline Reconstructed

Unlike companies that announce layoffs transparently, Boundless Learning’s reductions were scattered across regions, divisions, and time zones, leaving employees to piece together the broader picture. Below is the reconstructed sequence based on employee accounts, analyst writeups, and industry commentary.

| Wave | Date | Estimated Impact | What Happened |

| Wave 1 | Aug 2023 | ~50% | Staff notified via Zoom, accounts disabled within minutes, no severance, no PTO payout. |

| Wave 2 | Feb 2024 | ~15% | Cuts across academic advising, operations, and support teams; again no severance. |

| Wave 3 | Jan 2025 | 18–50% depending on department | Entire teams dissolved, particularly sales, marketing, and engineering. Reports of 200+ affected. |

The most jarring detail across all waves:

No warning. No severance. No transition period. No retained PTO.

Employee accounts consistently describe a pattern of:

● Cameras and microphones forcibly disabled mid-meeting

● Meeting hosts reading scripted notices

● Access revoked within 30 minutes

● No opportunity to retrieve personal items or documentation

This execution style aligns with Regent’s earlier controversial restructuring at Zulily — indicating that these cuts were not isolated decisions but part of a playbook.

4. Why the Layoffs Happened According to the Evidence

Four forces appear to have converged:

1. Revenue Collapse

POLS’s revenue had sharply declined after the loss of high-value contracts. Pearson publicly acknowledged a 69% drop in OPM revenue before the sale. Boundless inherited the deficit.

2. Private Equity Economics

Regent’s incentives were straightforward:

● Reduce operating costs rapidly

● Eliminate long-tail academic partnerships

● Push Boundless toward short-term profit

In private equity settings, “restructuring” often means “removing labor cost at speed.”

3. Failed Expansion and Product Strategy

Boundless attempted to:

● Enter non-U.S. markets

● Scale AI learning offerings

● Build new enterprise verticals

But reviews from within the company describe “unfinished AI tools,” “directionless expansion,” and “a leadership team completely disconnected from operational realities.”

4. EdTech Market Contraction

After COVID-era hypergrowth, EdTech demand normalized. Institutions moved away from outsourced online program management, tightening budgets and reclaiming internal control. Boundless was hit harder than most because its model was still tied to an era that was already ending.

5. What Frontline Employees Say About Company Culture

Employees describe the culture using terms like:

● “toxic”

● “directionless”

● “micromanaged”

● “chaotic”

● “profit-first to the point of unethical”

Several recurring themes emerge from reviews dated between Sept 2024 and Sept 2025:

Fear of being cut

“Always on edge wondering if it will be your last day.”

Abrupt restructuring cycles

Five reorganizations since the acquisition, each poorly communicated.

Loss of educational mission

“Everything is controlled by a financial firm who has no interest in education.”

AI/SaaS metrics replacing academic values

Talk time, dial metrics, and AI monitoring systems were introduced — unusual for organizations centered on student support.

No trust in leadership

Leadership was referred to as “incompetent,” “silent,” and “unreachable” in multiple reviews.

Collectively, these paint Boundless Learning not as a malfunctioning company but as a company operating in a way fundamentally incompatible with the norms of educational work.

6. The Biggest Controversy The Absence of Severance and PTO Compensation

The lack of severance became the defining outrage.

In North America and Europe — especially in education — severance is standard for reductions in force. Boundless Learning offered none, including:

● No severance pay

● No payout for unused vacation days

● No healthcare extensions

● No career transition resources

Employee accounts suggest this was intentional: contract terms were rewritten in June 2023 to remove severance obligations ahead of the rebrand.

Legal experts analyzing the case pointed out that certain jurisdictions (e.g., Canada, parts of the EU) may treat this as a violation of employment law, though no public lawsuits have been confirmed yet.

7. The Layoffs’ Impact on Boundless Learning’s Services

While Boundless promotes itself as stable and expanding, internal turbulence has consequences:

● Support response times reportedly slowed

● Program transitions left partner universities confused

● Academic advising capacity dropped sharply

● Engineering and product cuts risked platform stagnation

● Educator trust eroded due to uncertainty

Several reviewers predicted the business would “fizzle away” without a turnaround in leadership practices.

8. The Broader EdTech Implications

The Boundless Learning layoffs highlight several systemic cracks in the EdTech industry:

1. Post-pandemic contraction is real

Many EdTech firms built during 2020–2021 growth are now resizing to survive.

2. OPM (Online Program Management) is in decline

Universities want more control, leaving OPM-dependent businesses vulnerable.

3. Automation is reshaping workforce models

Companies are replacing human advising, support, and content creation with AI.

4. Private equity ownership can destabilize mission-driven sectors

Education is not retail — applying retail-style restructuring can damage service quality.

Boundless Learning may not be the last case of mass EdTech layoffs in 2025.

9. What Comes Next for Boundless Learning

Two paths appear possible:

A. Survival through specialization

Boundless may downsize into a leaner, partner-focused operation that offers limited but profitable services.

B. Gradual dissolution

A second interpretation emerging from employee reviews and analyst commentary is that Boundless Learning may be slowly weakening from within. Concerns consistently point to poor leadership, repeated restructuring, and the departure of experienced staff — all of which chip away at the company’s operational stability.

Each layoff round removes essential roles, and with them, the knowledge base that once supported programs across multiple regions. The resulting talent drain is paired with growing reputational damage, particularly around how workforce reductions were handled — sudden notices, no severance, and little transparency.

Overlaying this is sustained investor pressure, which appears to prioritize short-term cost cuts over long-term educational strategy. When financial directives override academic and operational needs, the organization risks shrinking faster than it can rebuild.

What concerns many observers is that Boundless Learning has not provided any public long-term roadmap, leaving the impression of a company contracting without a clear plan for recovery or future direction.

10. Final Assessment

Boundless Learning’s layoffs were not a market anomaly; they were the outcome of structural failures, financial engineering, and a misalignment between educational mission and private equity tactics.

The company’s internal reviews and external analysis align on one point:

The layoffs were not merely cost-cutting — they were symptomatic of a leadership model fundamentally unable to protect its workforce or stabilize its operations.

For thousands of learners and dozens of university partners, the story is still unfolding. But for employees, the message these layoffs sent was unmistakable:

Boundless Learning’s commitment to education was overshadowed by its commitment to survival.

Comments