Online survey platforms are not charities, and they are not scams by default. They exist because modern market research depends on speed, scale, and segmentation.

Companies pay for surveys because they need statistically useful opinions faster than traditional research methods allow. A consumer brand launching a new product might need 1,000 responses from people aged 18–25 in urban areas within 48 hours. A political research firm might need sentiment data filtered by region, income, and voting history. A mobile app developer might want feedback only from users who have installed a competitor’s app.

Online survey platforms act as intermediaries. They aggregate millions of potential respondents, filter them based on demographic data, and deliver clean datasets to researchers.

The key economic reality is this:

- Companies pay per completed, qualified response, not per attempt.

- Platforms must cover software, fraud detection, payment processing, and profit.

- Respondents are the lowest-cost input in the system.

That is why payouts stay low across the entire industry. According to publicly available market-research benchmarks, typical online survey costs range from $1 to $5 per completed response for general consumer panels, with higher rates only for rare or professional demographics. Out of that amount, only a fraction reaches the participant.

Screening questions exist to protect research budgets. If a study requires only people who own a specific car model, anyone outside that group is filtered out quickly. This is not personal. It is cost control.

Understanding this economic base is essential before evaluating FiveSurveys specifically.

Inside the FiveSurveys model: what makes it different on the surface

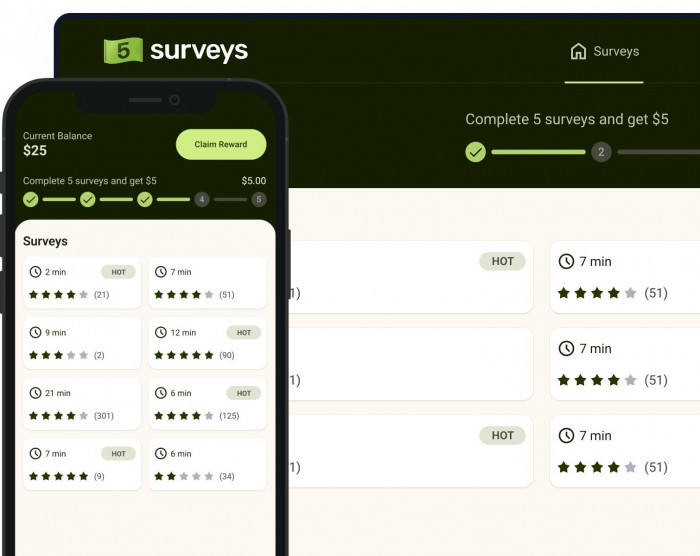

FiveSurveys stands out mainly because of how it presents the reward, not because it changes how surveys fundamentally work.

Most survey platforms show many surveys, each with a different payout. Users have to decide whether a 10-minute survey paying $0.50 is “worth it” compared to a 20-minute survey paying $2.00. That constant comparison creates friction and uncertainty.

FiveSurveys removes that comparison entirely.

Instead of paying per survey, it frames the system as:

Complete five successful surveys, then receive one fixed payout.

This feels simpler because the user no longer chooses between rewards. There is only one goal, and progress toward that goal is clearly tracked.

Psychologically, this matters more than it seems. A fixed target is easier to commit to than a series of small, variable decisions.

How the FiveSurveys process actually works step by step

Under the hood, FiveSurveys still follows the same logic as other survey platforms. The difference is how progress is counted.

Here is the full process in plain terms:

| Step | What it means for the user |

| Account creation | You sign up and provide basic details like age, location, and gender |

| Survey availability | The platform shows surveys that might fit your profile |

| Qualification checks | Each survey starts with screening questions to confirm eligibility |

| Survey completion | Only surveys you fully qualify for and complete count |

| Progress tracking | Each completed survey moves you closer to the “five” goal |

| Payout unlock | After five qualified completions, the reward becomes available |

The key detail is this:

starting a survey does not mean it will count.

If you fail the screening questions, that attempt ends and does not advance your progress.

Why this model feels easier but isn’t necessarily better

FiveSurveys does not increase earnings. It repackages effort.

By turning multiple small payouts into one visible target, the platform makes progress feel clearer and more motivating. However, the underlying economics remain unchanged:

- Surveys still pay low amounts

- Disqualifications still waste time

- Total earnings depend on how many attempts are rejected

In other words, FiveSurveys simplifies the experience, not the outcome.

That distinction is crucial for understanding what the platform can realistically offer and what it cannot.

The real earning mathematics: what the numbers actually say

This section matters more than any feature list.

To evaluate FiveSurveys realistically, we need to calculate effective earnings, not advertised rewards.

Average time per survey

Based on user reports across multiple survey platforms and typical market-research designs:

- Short surveys: 5–8 minutes

- Medium surveys: 10–15 minutes

- Long surveys: 20+ minutes (less common)

FiveSurveys surveys tend to cluster in the 8–15 minute range, based on available descriptions and user feedback.

Disqualification probability

Disqualification rates vary widely, but industry averages show:

- General consumer surveys: 30–50 percent disqualification

- Narrow demographic surveys: 60–80 percent disqualification

FiveSurveys does not eliminate screening. Therefore, realistic disqualification rates still apply.

For calculation, we use a moderate estimate of 40–60 percent.

Time cost to complete five qualified survey

| Scenario | Surveys attempted | Surveys completed | Total time | Effective hourly rate |

| Best case | 5 | 5 | ~50–60 minutes | ~$5.00/hour |

| Realistic | 8–12 | 5 | ~90–150 minutes | ~$2.50/hour |

| Worst case | 15+ | 5 | 3–4 hours | ~$1.40/hour |

These numbers align closely with the broader survey industry. They are not unusually low, but they are not competitive with traditional gig work or part-time jobs.

The psychology behind the design: why “five surveys” feels motivating

FiveSurveys does not innovate on earnings. It innovates on perception.

Behavioral economics research shows that goal-based progress tracking increases task completion. A visible counter that moves from 1 to 5 creates a sense of momentum that variable micro-payouts do not.

Key psychological mechanisms at play

Progress bar pressure

Once a user completes two or three surveys, stopping feels like loss. The remaining effort feels smaller than it objectively is.

Fixed reward framing

A single payout feels more meaningful than fragmented cents, even if the total value is the same.

“Almost earned” effect

Near-completion creates psychological ownership over the reward, increasing persistence even when time costs rise.

These mechanisms are well-documented in UX and behavioral design research. They are not unethical by default, but they do influence how users perceive effort versus reward.

The platform benefits from higher completion persistence. The user experiences stronger motivation, even when earnings remain unchanged.

User experience as data

Instead of quoting individual reviews, it is more useful to aggregate patterns.

Aggregate review trends observed across public platforms

| Theme | Frequency |

| Disqualification frustration | Very high |

| Low earnings realism | High |

| Simple interface | Moderate positive |

| Payout delays | Occasional |

| Account verification issues | Low to moderate |

The dominant experience is not anger or praise. It is neutral disappointment mixed with acceptance.

Users who understand survey economics tend to view FiveSurveys as “working as expected.” Users who expect fast or meaningful income tend to feel misled, even when the platform operates correctly.

This gap between expectation and reality explains most negative sentiment.

Friction points, risks, and limitations

FiveSurveys shares most limitations common to the sector, but they deserve clear explanation.

Disqualifications

These are structural, not accidental. Research clients control screening criteria. The platform cannot override them.

Survey supply

Availability fluctuates based on region and market demand. Users in the US, UK, and Canada typically see more opportunities than users elsewhere.

Payout timing

While many users report successful payouts, delays can occur due to verification checks or payment processor issues.

Data privacy

Like all survey platforms, FiveSurveys collects demographic and response data. This data is the product being sold. Users should assume their answers are anonymized but commercially used.

None of these risks are unique, but they limit usefulness.

How FiveSurveys compares with real alternatives

Judging FiveSurveys in isolation creates distorted conclusions. Comparison provides context.

Quantitative comparison

| Platform type | Typical hourly rate | Minimum payout | Reliability | Effort level |

| FiveSurveys | $1.50–$5.00 | Fixed at 5 surveys | Medium | Medium |

| Major survey sites | $1.00–$6.00 | $5–$10 | Medium | Medium |

| Micro-task platforms | $3.00–$10.00 | Variable | High | High |

| Small gig apps | $8.00–$15.00 | Low | High | High |

FiveSurveys performs about average within the survey category and well below gig-based alternatives.

Who should actually use FiveSurveys

A data-based suitability breakdown helps remove emotional bias. Survey platforms tend to disappoint users not because they malfunction, but because expectations are misaligned with how the system is designed to work.

Understanding who FiveSurveys fits and who it does not is more useful than deciding whether it is “good” or “bad.”

Reasonable use cases

1. Students needing very small amounts of flexible cash

Students often have fragmented schedules and short blocks of idle time between classes. For this group, FiveSurveys can convert otherwise unused minutes into a few dollars without long-term commitment. The trade-off is low pay, but flexibility is high.

2. People testing whether survey income fits their tolerance

Some users want to understand survey platforms before investing time elsewhere. FiveSurveys offers a contained way to experience qualification filters, disqualifications, and payout mechanics without navigating dozens of variable-paying surveys. As a test environment, it serves its purpose.

3. Users with idle time and low income expectations

People who already expect earnings to be minimal tend to be less frustrated. For them, the platform is closer to a time-filler that occasionally pays rather than a serious income source. This mindset aligns best with the actual economics.

Poor fit scenarios

1. Anyone expecting income comparable to part-time work

The effective hourly rate of FiveSurveys, even in best-case scenarios, does not approach minimum wage in most regions. Users expecting steady or meaningful income will almost always feel the time-to-reward ratio is unfavorable.

2. Users sensitive to time inefficiency

Survey disqualifications are common and unavoidable. People who strongly dislike spending time without guaranteed payoff often find survey platforms mentally draining, regardless of how the reward is framed.

3. People uncomfortable sharing demographic data

Survey platforms operate by collecting and filtering demographic information. Users who are cautious about sharing age, location, income range, or consumer behavior may find the model fundamentally misaligned with their privacy preferences.

Comments